The interest rate collar involves the simultaneous purchase of an interest rate cap and sale of an interest rate floor on the same index for the same maturity and notional principal amount.

Interest rate caps floors and collars.

The issuer of a floating rate note might use this to cap the upside of his debt service and pay for the cap with a floor.

Interest rate swap in hedging variable rate debt with a swap an organization agrees to pay out a fixed amount each month to a counterparty in exchange for receipt of a variable rate.

The premium for an interest rate collar also depends on the rollover frequency and how you make your premium payments.

For pen drive classes contact no.

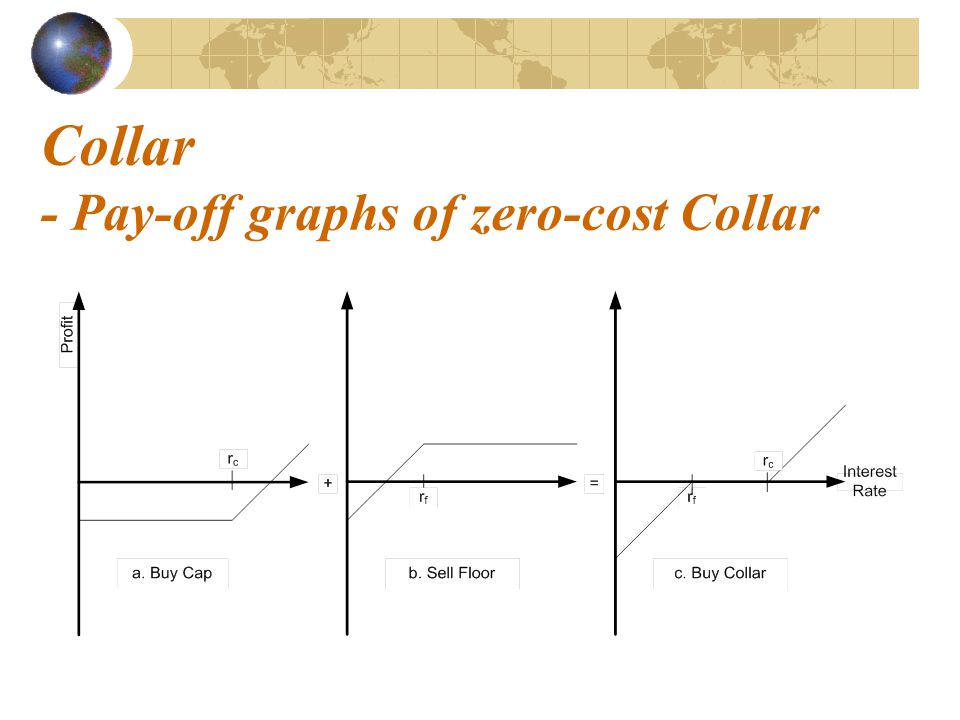

An interest rate collar can be created by buying a cap and selling a floor.

Caps floors and collars are option based interest rate risk management products that put limits to the interest rates.

For example as a borrower with current market rates at 6 you would pay more for an interest rate collar with a 4 floor and a 7 cap than a collar with a 5 floor and a 8 5 cap.

Or investor may buy a floor to avoid any future falls in the interest rates.

Caps floors and collars 13 interest rate collars a collar is a long position in a cap and a short position in a floor.

When the cost of the floor sold equals the cost of the cap purchased it is.

This organization has purchased a 5 cap and sold a 2 floor which provides the organization with an interest rate collar of 2 to 5.

This creates an interest rate range and the collar holder is protected from rates above the cap strike rate but has forgone the benefits of interest rates falling below the floor rate sold.

An interest rate cap is a derivative in which the buyer receives payments at the end of each period in which the interest rate exceeds the agreed strike price an example of a cap would be an agreement to receive a payment for each month the libor rate exceeds 2 5.

They are most frequently taken out for periods of between 2 and 5 years although this can vary considerably.

:max_bytes(150000):strip_icc()/strategy-4086857_19201-23485cf7c4bf4dbbb95c93f267285f16.jpg)