Similarly rate floors protect the banks profit margins if rates go into the tank.

Interest rate caps and floors.

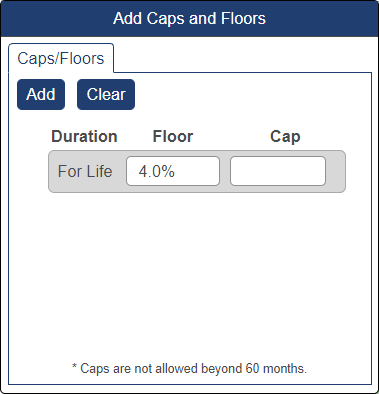

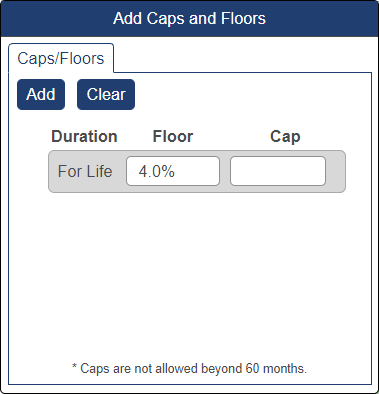

Caps and floors are based on interest rates and have multiple settlement dates a single data cap is a caplet and a single date floor is a floorlet.

In both products the buyer of the contract.

Caps floors and collars 2 interest rate caps a cap provides a guarantee to the issuer of a floating or variable rate note or adjustable rate mortgage that the coupon payment each period will be no higher than a certain amount.

Borrowers are interested by caps since they set a maximum paid interest cost.

Interest rates standard options are caps and floors the cap guarantees a maximum rate to the buyer.

Caps and floors can be used to hedgeagainst interest rate fluctuations.

Like other options the buyer will pay a premium to purchase the option so the buyer faces credit risk.

Interest rate caps and floors an interest rate cap establishes a ceiling on interest payments.

It has value only when the rate is above the guaranteed rate otherwise it is worthless.

An interest rate floor is similar to an interest rate cap agreement.

An interest rate cap is an otc derivative where the buyer receives payments at the end of each period when the interest rate exceeds the strike whereas an interest rate floor is a similar contract where the buyer receives payments at the end of each period when the interest rate is below the strike.

Interest rate floors and interest rate caps are levels used by varying market participants to hedge risks associated with floating rate loan products.

An interest rate floor is an agreed upon rate in the lower range of rates associated with a floating rate loan product.

Caps and floors are like calls and puts and they are related through a parity relation which relates them to the value of a corresponding swap.

On the other hand if you invested in a floating rate note and receive floating rates you ll want to protect yourself against too low rates.

Interest rate caps and floors are option like contracts which are customized and negotiated by two parties.

Investopedia delivers a succinct explanation.

In other words the.

In this case you ll want to buy a so called floor.

A cap is an option.

For example a borrower who is paying the libor rate on a loan can protect himself against a rise in rates by buying a cap at 2 5.