When investing in a home improvement project such as insulated siding it is great to not only get the energy savings year after year but also put a few bucks back in your pocket at tax time.

Insulated vinyl siding tax credit.

Vinyl siding is not an eligible improvement for the energy tax credit but it may qualify for the sales tax deduction instead.

You can claim a credit if we carve out a new space a door that wasn t there before.

Tax credits or funds that are deducted from the total a taxpayer owes to the state are being offered for energy efficient upgrades that are made to homes.

The united states government offers tax credits to homeowners for energy efficiency in order to reduce homeowners utility bills increase energy independence and to lower pollution.

Energy efficient tax credits energy efficiency tax credits are credits that a homeowner can claim on his federal income tax return for home improvements he made that improved the energy efficiency of his home.

You can take deductions for the sales tax you paid on vinyl siding in minnesota during 2017.

This tends to be especially common in areas that are attempting to revitalize their neighborhoods and want to encourage renovations of older homes.

The best place to start is by contacting your local city hall.

The credits may be as high as 10 of the cost up to 500 for windows.

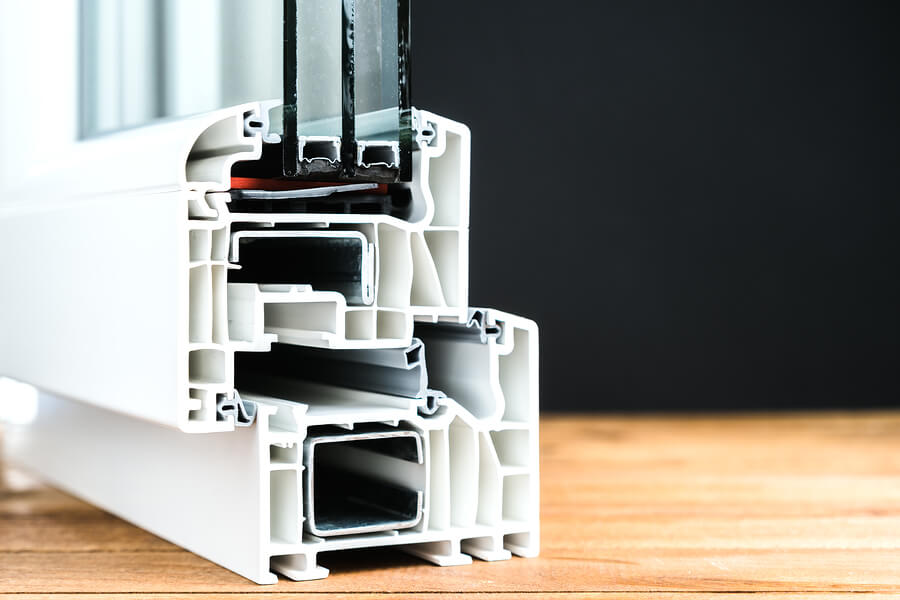

Homeowners cannot take a tax credit for vinyl siding but they can take a residential energy credit at the federal level if they purchase vinyl siding insulation.

Some of these include credits towards wall insulation products which can include siding insulation that is installed underneath new siding.